It took a decade of waiting, but Bitcoin finally got its ETF moment. On Thursday, shares from BlackRock and nine other ETF issuers began trading and so far it looks like the new product is a hit. The Wall Street Journal described the moment as a “monster start” for Bitcoin ETFs while Bloomberg wrote that the new shares “took Wall Street by storm.”

As proof of success, market watchers pointed out that $4.6 billion worth of Bitcoin ETF shares changed hands, suggesting demand for the product was both broad and deep. BlackRock’s fund alone saw over $1 billion of trading volume, which came close to being the biggest ETF debut in history, not far behind the $1.16 billion in volume that the firm’s “carbon transition” ETF notched on its first day in 2021.

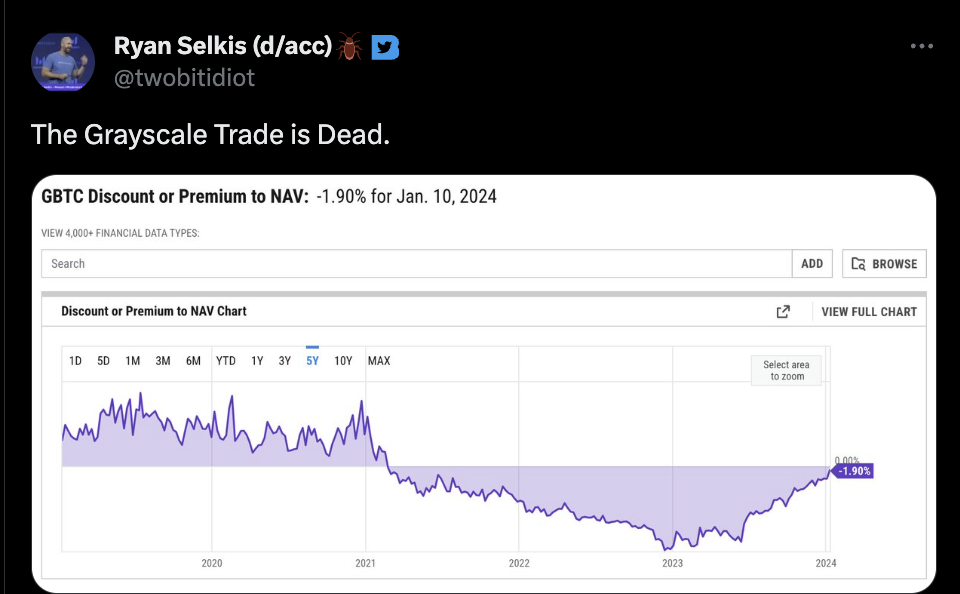

The volume numbers are impressive, but there are also some caveats. One is that a good chunk of Thursday’s volume likely came as a result of outflows from Grayscale—which “uplisted” its off-brand trust shares into an ETF but is maintaining an outsize fee—and from the fact that BlackRock and others had pre-arranged “seed capital” for their new funds to goose initial demand. It will take a few weeks until we get a clear idea of whether the first-day enthusiasm for the new Bitcoin ETFs translates into long-term demand, including from retail investors. But, for now, it’s safe to say that the new products are not a bust.

Meanwhile, a few other storylines emerged. These included asset management giant Vanguard electing not to offer the ETFs on its platform because the company believes they are too risky. The decision carries a whiff of paternalism and, some may suspect, of sour grapes too since Vanguard—unlike BlackRock, Fidelity, and Franklin Templeton—did not spin up a Bitcoin ETF of its own. But as Vanguard has made similar decisions in the past over what it perceives as high-risk assets, its “no Bitcoin” policy is likely rooted in genuine, if misguided, concern for its customers.

Another emerging story is that, in the face-off between traditional finance firms and pure crypto players to offer Bitcoin ETFs, the former appear to have won out. As it turns out, claims of Bitcoin authenticity or whatever lost out to the huge liquidity and familiar brand name offered by BlackRock and others.

Finally, the launch of the ETFs has proved an occasion to reflect on what Bitcoin even stands for anymore. Some have noted it is ironic that a project that began as a rebellion to big banks and the government has gone mainstream in the form of Wall Street packaging. I think that’s beside the point though. If people want to exchange Bitcoin outside of the financial system, they absolutely can do it—and it’s cheaper to boot.

Thanks for reading, and please note Fortune Crypto will return to your inboxes on Tuesday after the MLK Day holiday.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

New York's Department of Financial Services stripped Genesis of its BitLicense as part of an $8 million settlement with the DCG subsidiary. (Fortune)

Circle filed for a confidential IPO after the stablecoin giant unsuccessfully tried to go public via a SPAC in 2022. (Reuters)

Franklin Templeton, whose Bitcoin ETF attracted less interest than those of Fidelity or Vanguard, slashed its fee to 0.19%. (CoinDesk)

CoinShares exercised an option to buy the Bitcoin ETF business of rival Valkyrie following its soft debut on Thursday. (Bloomberg)

The share prices of Coinbase, MicroStrategy, and Bitcoin mining stocks all slumped on the day of the ETFs debut. (The Block)

MEME O’ THE MOMENT

The end of Grayscale arbitrage:

This is the web version of Fortune Crypto, a daily newsletter on the coins, companies, and people shaping the world of crypto. Sign up for free.