Asia’s companies have long traipsed to either the New York Stock Exchange or the Nasdaq for their public debuts. Southeast Asian tech giant Sea, for example, listed on the NYSE in 2017. More recently, Hong Kong– and Singapore-based travel platform Klook recently filed for a listing on the NYSE.

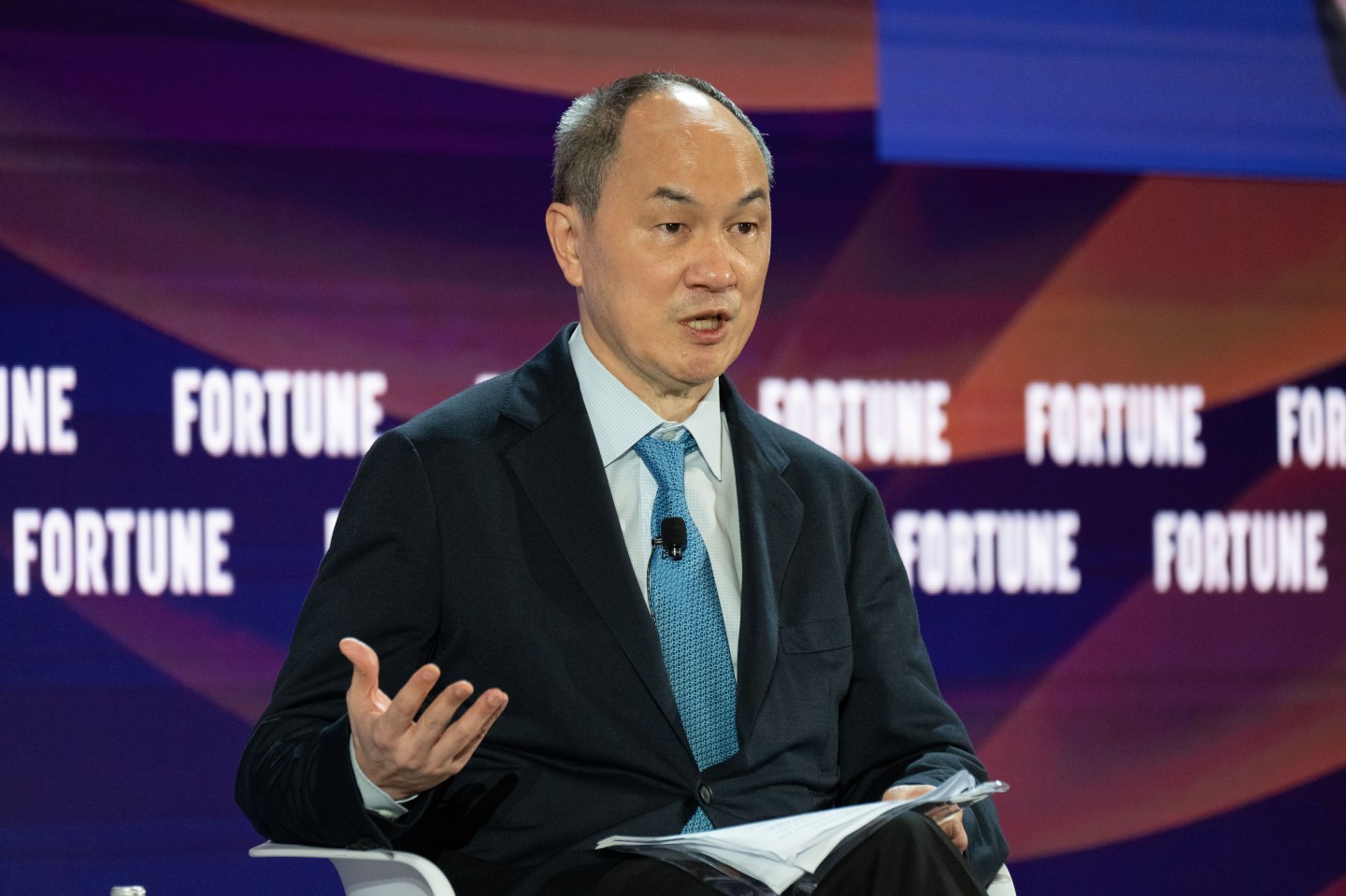

“Historically, we’ve been dominated by one major capital market, i.e., the U.S. and Wall Street,” said Vikram Lokur, chief executive officer (Singapore) for Morgan Stanley Investment Management, at the Fortune Innovation Forum in Kuala Lumpur, Malaysia, on Tuesday.

But that might be changing, as companies explore the possibility of listing in non-U.S. markets. “I think we’re coming into an era of what we would like to call the re-globalization of regional hubs,” Lokur said.

Hong Kong, for example, has seen a surge of dual listings over the past year, both from companies listed in mainland China hoping to tap international capital, and U.S.-listed Chinese companies that want access to mainland Chinese investors.

Some exchanges have initiated programs to encourage people to invest locally rather than overseas, potentially spurring an era of financial nationalism.

“In the past, we were much more reliant on foreign capital, but today, not so much,” said Jason Saw, group head of investment banking at CGS International Securities. “Malaysia is home to one of the largest pension funds in the region … The Monetary Authority of Singapore has initiated a program to invest 5 billion Singapore dollars ($3.8 billion) into the local market. So we’re seeing a trend of governments asking for funds to invest in local markets.”

Some Asian governments, particularly Japan, have launched reform schemes to improve corporate governance and increase shareholder value among listed companies. Japan’s success in this regard, with the Nikkei 225 reaching all-time highs in recent years, is encouraging other governments like South Korea, Singapore, and Malaysia to enact their own reform programs.

There’s “cautious optimism,” said Yuelin Yang, who sits on the board of the Asian Corporate Governance Association. But issues like cross-shareholdings—where companies hold shares in each other—and tunneling—where a majority shareholder secretly funnels business to themselves for personal gain—are still creating “a lot of nitty-gritty differences in each market,” he warned.

‘One bloc’

Southeast Asia’s markets alone may not be as large as those of their regional peers. Both the U.S. and China offer deep pools of institutional and retail capital. But Saw, of CGS, suggested that ASEAN (the Association of Southeast Asian Nations) as a whole might be large enough to compete.

“I am very optimistic about the capital in ASEAN and the connectivity that we can do. If we’re able to narrow that pool of capital together to say that we’re one bloc, that’s going to be something really powerful” he said.

Southeast Asia’s IPO market, after a lengthy slump, is starting to recover. According to Deloitte, total IPO proceeds across Southeast Asia are up by 53% so far this year, with particular energy in the real estate, financial services, and consumer sectors.

But the question of where to list may soon become less relevant in the future, particularly as new tools and services allow investors to more easily access global markets.

“The key question for many companies in the last century was where to list. But for the next century it would be about how to connect,” Lokur, of Morgan Stanley, said. “This is a reimagining of finance itself.”