This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. Let’s spin the roulette wheel, and see what the Reddit brigade is targeting today… Yep, it’s silver. You may have seen #Silversqueeze trending on Twitter this weekend. Well, this morning spot silver prices are trading at a 5-month high, and that’s lifting mining stocks, and it’s even influencing the gold market.

If you were unimpressed with last week’s retail-led rally in GameStop, I get that. But the precious metal trade is a far bigger target. You don’t often see such massive overnight moves.

On a positive note, there’s a lot of green on the screens as a risk-on mood overtakes the markets this morning.

Let’s see what’s where investors are putting their money.

Markets update

Asia

- The major Asia indexes are bounding back in afternoon trading, with Hang Seng up 2.2%.

- TikTok rival Kuaishou Technology is looking to raise $5.4 billion in a Hong Kong-based IPO later this week, which would be the biggest listing anywhere in the world in over a year.

- Aung San Suu Kyi and other top leaders in Myanmar were detained in an early-morning raid on Monday that puts the military back in charge of the restive country.

Europe

- The European bourses were higher out of the gates with the Stoxx Europe 600 up 0.8% at the open.

- Following a video call over the weekend with the heads of vaccine-makers AstraZeneca and Moderna, Commission President Ursula von der Leyen took to Twitter to announce she’d won some concessions for 9 million additional AZ doses. That won’t get the EU back on track, but it’s better than nothing.

- Meanwhile, the United Kingdom is on pace to deliver on its promise of vaccinating its care-home residents. Just don’t ask when they’ll get that second dose.

U.S.

- U.S. futures are rebounding this morning. That’s after the three major indexes suffered their worst weekly losses since October, pushing the Dow and S&P 500 into the red for 2021.

- Robinhood has trading restrictions in place on eight stocks (down from 50 names) this morning including familiar names GameStop, AMC Entertainment, BlackBerry and Nokia.

- Limiting trade in GameStop could explain why the volume of GME futures is light in the pre-market this morning. Still, volatility is sky-high just about everywhere else. The VIX has climbed nearly 50% since last Tuesday, and it’s up again this morning.

- Investors looking for a distraction from the GameStop frenzy may just get it from earnings. Amazon and Alphabet’s Google report tomorrow, as does Pfizer and UPS.

Elsewhere

- Gold is up sharply, trading above $1,860/ounce.

- The dollar is flat.

- Crude is up, with Brent trading around $55/barrel.

- As of 10 a.m. Rome time, Bitcoin was flat at $33,780. The big news was around Dogecoin, which was proving to be the dog of the crypto trade, crashing more than 40% at one point over the weekend.

***

Winners and losers

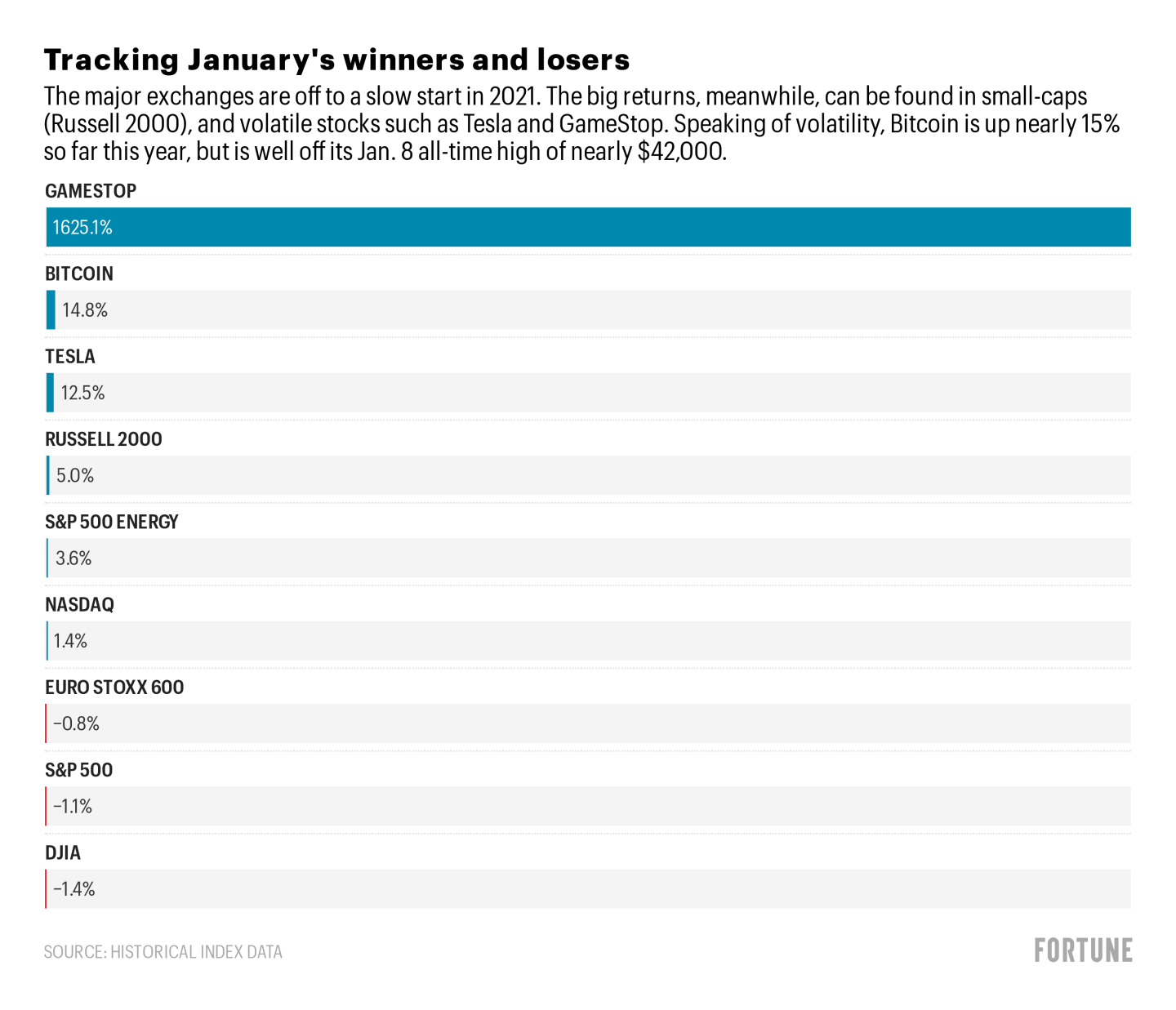

Let’s look back on the big hits and misses for January, as we do each month.

January was a tale of two halves. The first part of the month saw an impressively broad rally across risk assets. Tech, energy and small-caps all gained, helped by decent, and even very good, earnings. Bitcoin too hit an all-time high on Jan. 8, before cooling off. (It’s technically in correction territory since then.)

Last week, we saw a major global de-risking event that, according to Morgan Stanley (as first reported by The Market Ear), nearly matched what we observed last March during the great markets plunge. Let that sink in. A pandemic causes hedge funds to liquidate their positions at an epic pace. Ten months later, a frenzy of day traders triggers a similarly massive short squeeze that forces the hedgies to dump their longs, and cover their shorts.

That trade sent the VIX skyward and sunk many of the winning bets from earlier in the month. Let’s go to the chart.

Up 1625%, GameStop is far and away the big winner for January. To put that in perspective, Tesla’s monster 2020 rally topped out at +743%. Pretty good, but not GME good.

After GameStop, the big winners were Bitcoin (+14.8% in January), the small caps (+5%), energy (+3.6%) and tech (1.4%). The losers were the benchmark indexes and the Dow. The Euro Stoxx 600 was off 0.8% and the S&P fell 1.1%. If you have a Dow-targeted ETF in your portfolio you know full well it’s off to a bad start.

Coming into 2021 there was a lot of excitement about earnings season. And the first batch of results surprised on the upside, creating a surge in investor enthusiasm that then got quashed in last week’s feeding frenzy.

Earnings season is far from over. A lot of big names, including Dow components, report in the coming days. Let’s see if the big caps can steal some of the spotlight away from the likes of Tootsie Roll.

***

Postscript

Alessandro, my thirty-something barber here in Rome, is a sweet guy—that is as long as you can keep the conversation to lighter fare: the weather, travel, popular culture.

Whenever I come in for a snip, I do my level best to focus the discussion to the dolce vita stuff: what’s trending on Netflix, or the ups and downs of AS Roma. The small talk strategy never lasts.

Before long, he mentions the failings of the Italian government and our ineffectual mayor. I mostly nod in agreement with his observations. He then goes on the attack against the EU, saying it should be blown up. I try to point out the folly of highly indebted Italy going it alone, and he counters with a non-sequitur about the Greek financial crisis. At this point I know we’re both about to get loud. Really loud.

He believes globalization is a disaster, and that Goldman Sachs and Wall Street are colluding to put us all on the streets. “Goldman Sachs?!,” I usually gasp incredulously. “Caro mio, you’ve got to find a new vampire squid, one from this decade.”

I was expecting similar fireworks on Saturday morning when I stopped in for a hair cut. A few days earlier, the Italian government plunged into typical chaos. The prime minister has resigned, and now with each passing day it’s unclear what kind of government will form (if any), leaving the management of a crucial COVID bailout for households and businesses in limbo. A prolonged government crisis would be really bad news for businesses like Alessandro’s.

I expected Alessandro to rail about the latest turmoil, but he only wanted to talk about one thing: GameStop.

He’s a fan of the Reddit brigade.

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

January is the cruelest month. It is if you're Melvin Capital founder Gabe Plotkin. Melvin had a huge short position on GameStop, one of a series of bets that went sour in a big way. The hedge fund is down 53% in January, the Wall Street Journal reports, citing people in the know. That includes a $2.75 billion bailout from "Citadel LLC, its partners and Mr. Cohen’s Point72 Asset Management," the paper reports.

Bubbles, bubbles everywhere. Bitcoin. SPACs. Out of whack valuations. A frenzy in options trading on unprofitable firms. Are these signs of a bubble? The WSJ digs into previous eras of highly speculative trading to answer the question of whether these trade in these volatile assets all add up to a market-wide bubble.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

$19.75 billion

The GameStop rally could very well go down as the mother of all short squeezes. The hedge funds and other investors who've shorted the retailer were on the hook, as of Friday, for a $19.75 billion loss for the month of January. Crazier still, the data shows the shorts aren't done. According to Fortune's Jen Wieczner, "sellers aren't done betting against GameStop—and many are just getting started."