This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. With the exception of the dollar, the screens are a blur of red this morning. Bitcoin, crude, gold, global stocks, U.S. futures—they’re all faltering. Not even Reddit bulls can muster the magic to extend the GameStop rally.

At the close of trading yesterday there were mounting worries that the GameStop squeeze was hitting the wider markets. As futures plunge this morning, that concern is morphing into legit fears.

In today’s essay, I dig deeper into the phenomenon of viral stocks like GameStop, and what it means to your portfolio.

But first, let’s see what’s moving the markets.

Markets update

Asia

- The major Asia indexes are slumping in afternoon trading, with Hang Seng down 2.6%.

- The GameStop effect is going global with retail investors from Sydney to Amsterdam bidding up stocks to catch out short investors. One winner from the increased volatility this morning is the previously undervalued Japanese e-commerce giant Rakuten, up 7.5% in Tokyo.

- Could the once high-flying fintech Ant Group really remake itself into a stodgy bank holding company? That’s the plan being floated to appease Chinese authorities.

Europe

- The European bourses were lower out of the gates with the Stoxx Europe 600 down 0.8% at the open, before falling further.

- Shares in Volkswagen were down 1% in early trading after the German automaker slipped to the world’s second biggest car company behind Toyota, handing over the crown after a five-year run.

- COVID vaccine shots are running out fast in Europe, putting huge pressure on Brussels to find a fix. It won’t come from AstraZeneca any time soon. The EU tried and failed yesterday to force the drugmaker to divert supplies from its U.K. factories across the English Channel. Reminder: the EU hasn’t yet granted regulatory approval for even a single dose of the AZ vaccine.

U.S.

- U.S. futures point to another weak open. That’s after the S&P 500 and Dow yesterday suffered their worst losses since October on a mixed batch of earnings.

- Shares in Apple are down 3.3% in pre-market trading after the iPhone maker posted knock-out earnings, and hit a series of records. Why is the stock slumping? As Fortune‘s Aaron Pressman explains, investors are unclear where its next big hits will come from.

- With Big Tech disappointing, what about the small fries? In the pre-market, GameStop is down 16% and AMC Entertainment has plunged 27% after monster rallies on Wednesday. Meanwhile, the startling rise in these Reddit-fueled trades has caught the eye of U.S. Treasury Secretary Janet Yellen and the White House.

- That scrutiny is probably too late for hedge fund kings like Steve Cohen, Gabe Plotkin and Dan Sundheim. They’re out billions so far on the GameStop short squeeze.

Elsewhere

- Gold is down, trading below $1,840/ounce.

- The dollar is up.

- Crude is slumping, with Brent trading around $55/barrel.

- As of 10 a.m. Rome time, Bitcoin was down nearly 2% at $31,000. It’s had a rough two-day stretch, coinciding with the slump in big-cap stocks.

***

Viral stocks

What happens when YOLO goes FOMO? You get tendies and 🚀🚀🚀, of course.

Let me explain. There’s a new kind of stock we need to familiarize ourselves with. We’ve spoken often here about value stocks and growth stocks. Well, now there are viral stocks.

“Just like there are viral tweets, there are viral stocks,” Ivan Ćosović, founder of Dusseldorf-based Breakout Point GmbH, a data analytics firm that tracks retail investors and activist shorts, told me yesterday.

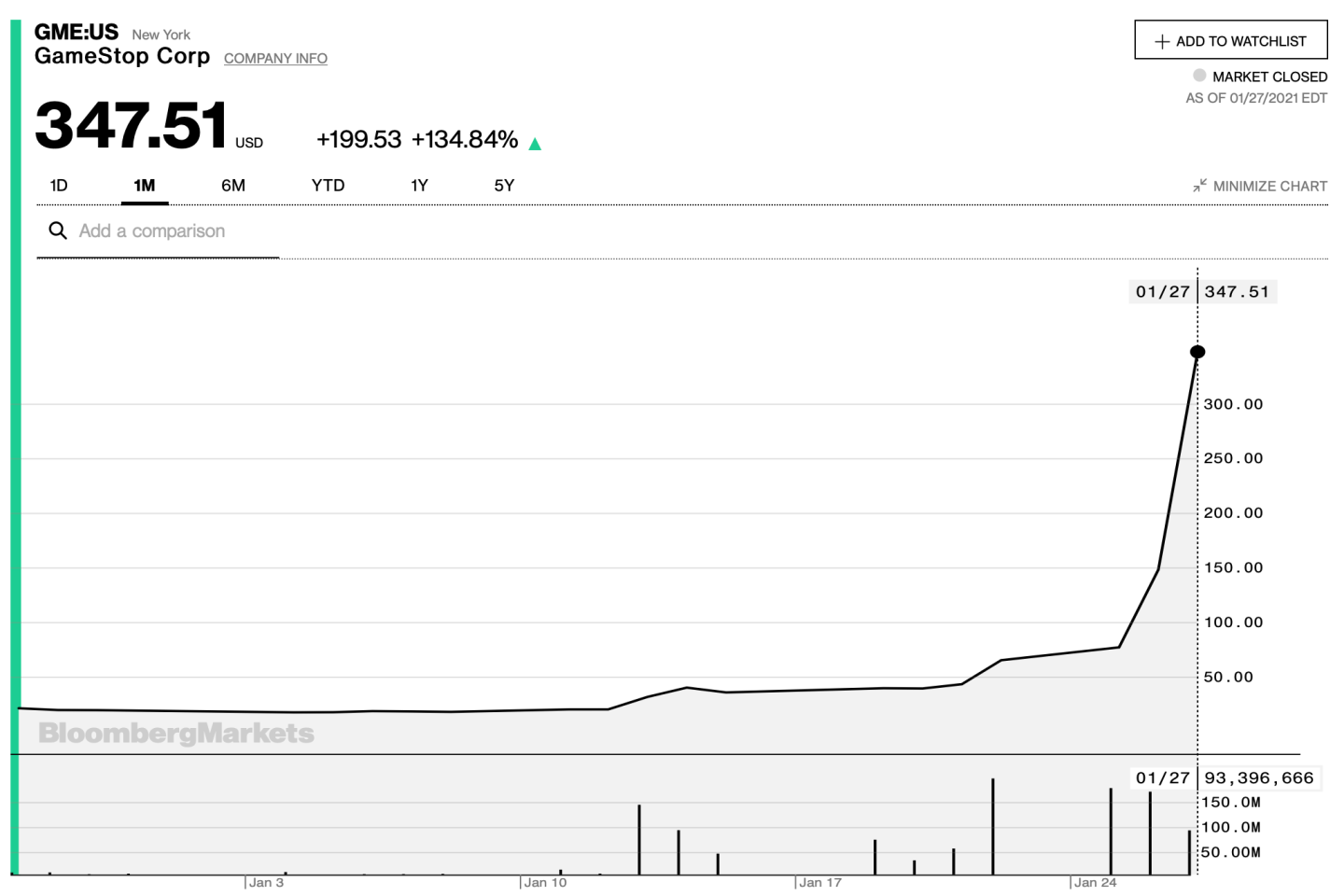

Breakout Point has been tracking the growth over the past year in stocks that get chatted-up on investor message boards—forums such as Reddit’s WallStreetBets. The most attractive grow in interest from a few comments to a torrent. Shortly after that, many of these chatted-up minnows—names like GameStop and AMC Entertainment, but also penny stocks like OcuGen and Zomedica—make the jump to Robinhood’s “100 Most Popular” list. From there, the army of retail investors bid them up, turning the occasional guppy into a Wall Street whale like GME.

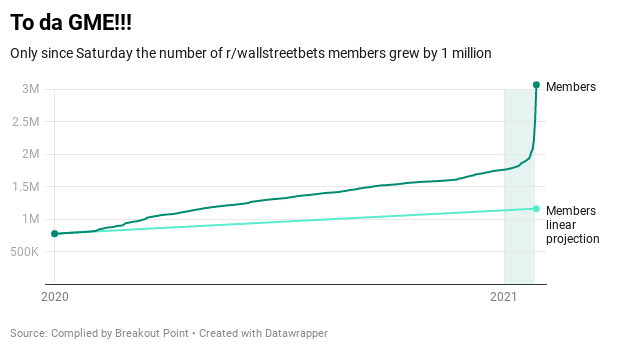

Don’t be fooled. WallStreetBets is no amateur chat room. It’s become a force in the markets. And it’s growing like gangbusters. The parabolic surge in subscribers in recent days (they’ve clocked more than 1 million new subs between Saturday and Wednesday afternoon, as the next chart below shows) resembles the share price chart for, ahem, GME.

What’s so daunting to Wall Street pros is that many of these stocks are making the jump to the big time for no other reason than they’re getting a lot of buzz on message boards. Breakout Point describes this as a swarm. (As Ćosović’s described this, my mind went to that creepy Black Mirror episode featuring the out-of-control swarms of mechanical bees programmed by social media mobs.)

What makes a viral stock worthy of retail investor attention? There’s a bit of gamesmanship at play. As we’ve seen from AMC and GameStop, it helps if the stocks have been targeted by shorts and hedge funds. But a lot of times these stocks pop for no other reason than they’re getting a lot of buzz. In this way, the narrative behind the stock counts more than news flow or fundamentals.

What’s the narrative? “Today, the story is AMC. Tomorrow it’s something else,” Ćosović told me yesterday, before adding, “and no story is too small.”

It all sounds very fuzzy, but retail investors are making serious bank—”tendies” in Reddit parlance—on these trades.

But before you plot your next move, consider what UBS’s chief economist Paul Donovan says in a sobering investor note this morning.

“The story told about the Reddit-inspired bubbles is that wealth is being transferred from large short sellers to ordinary retail investors. The longer the bubbles last, the less likely that is to be true,” Donovan writes. “Instead, wealth is transferred from ordinary investors to bubble sellers. That transfer becomes permanent when the bubble bursts.”

Bubble sellers do well during investing manias. That’s not narrative. That’s fact.

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

The most Mets story ever. Fans of the New York Mets, including yours truly, have looked at the GameStop carnage and thought, here we go again. Mets owner Steve Cohen's Point72 hedge fund has bailed out Melvin Capital to the tune of $750 million to cover Melvin's short bets on GameStop that went awry. That's prompting Mets fans young and old to recall how the former team owners got fleeced in the Madoff scandal more than a decade ago. Cohen himself took to Twitter to calm Mets' fans fears that, no, this won't affect payroll... If that's the case, where's our new centerfielder!?

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day

When people are getting run over and they have to raise cash, I wouldn’t be surprised if there’s a little bit of that going on right now, because God knows more than one hedge fund was short GameStop.

That's Russell Rhoads, head of research and consulting at EQDerivatives, who explains to Fortune's Anne Sraders why the wider market fell yesterday on the great GameStop squeeze.