This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Happy Friday, everyone. We look to close off a volatile week on an up note as the U.S. futures point to decent gains. But it’s a mixed picture everywhere else. Brexit uncertainty is holding back European stocks and global stocks are on track for their second consecutive week of losses.

Let’s check in on the action.

Markets update

Asia

- The major indexes are mostly in the green with Japan’s Nikkei leading the way, up 0.75%.

- The fate of TikTok’s U.S. operations is very much uncertain, but one thing is clear: President Trump will not budge on his Sept. 15 deadline to shut it down if an acquisition fails to materialize.

- Rio Tinto has announced CEO Jean-Sébastien Jacques and top unit heads are out of a job as the controversy around the mining giant’s destruction of ancient Aboriginal heritage sites in Australia intensifies.

Europe

- The European bourses were down at the start with the Stoxx Europe 600 off 0.2%, before ticking upwards.

- A summer-holiday surge in COVID cases means Europe has once again overtaken the U.S. as a major coronavirus hotspot. The 27-country bloc reported more than 27,000 new cases yesterday. These region-by-region comparisons are hardly perfect measures; Europe’s population is 450 million versus 330 million in the U.S. Still, it’s not a good trend.

- If you were suffering from Brexit fatigue, don’t change that dial. The odds of a chaotic divorce are on the rise as the EU is now giving Britain to the end of the month to back down from its threat to rewrite the terms of the deal. Britain is even getting heat from House Speaker Nancy Pelosi not to do anything drastic, like put the Good Friday according in jeopardy. Threatening to walk away with no deal may be a negotiating tactic, but it comes with huge risks. Nearly two-thirds of Britain’s exports flow to the EU and U.S., according to economists at Berenberg Bank.

U.S.

- The U.S. futures are in the green this morning, looking to recover some of yesterday’s losses. Disappointing jobless numbers and the Senate’s failure to even vote on a slimmed-down stimulus relief package didn’t help stocks yesterday. The Nasdaq fell nearly 2%.

- Yesterday’s sell-off came despite an incredibly bullish GDP call from Goldman Sachs which now predicts the U.S. economy will grow as much as 35% this quarter, well above economists’ estimates.

- The coronavirus pandemic is ravaging New York City’s economy. It’s also taking its toll on the city’s quality of life, the region’s biggest employers complain. The top execs at 160 companies, including Citigroup, Mastercard, and Nasdaq, sent a signed letter to New York Mayor Bill de Blasio urging him to restore basic services that were cut when the outbreak hit the city.

Elsewhere

- Gold is down, trading below $1,950/ounce.

- The dollar is down.

- Crude is flat with Brent trading near $40/barrel.

By the Numbers

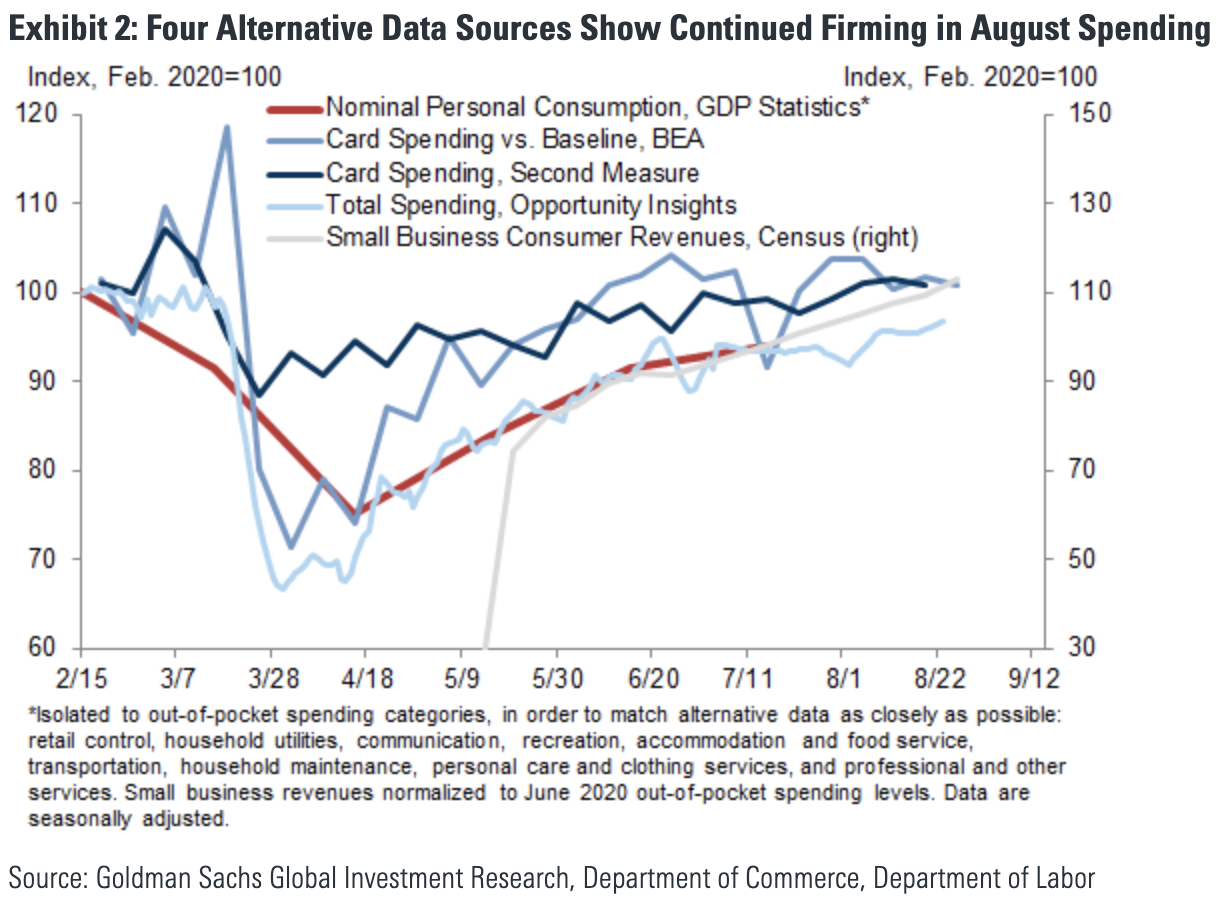

35%. The consumer is the engine of the U.S. economy, responsible for roughly 70% of GDP. And so Goldman Sachs economists are heartened to see that consumer spending picked up in July and August, suggesting the economic rebound is on firmer footing than previously assumed. The rapid rebound in consumer spending is one of the big reasons Goldman is now predicting a Q3 GDP leap of 35%.

-9.4%. The Nasdaq is roughly a half-percent away from returning to correction territory. Since its Sept. 2 record close, the tech-laden index has fallen 9.4% as investors rethink the lofty valuations of Big Tech stocks. Apple is down 15.3% since its Sept. 1 high. Tesla is faring even worse, plunging 25% from its split-adjusted all-time high, achieved on Aug. 30. That’s solidly in bear territory. Alas, although Nasdaq futures point to a rebound as I write, trading has, as we know, been incredibly volatile recently.

4.9%. Quiz time: which of these four major exchanges is the top-performer over the past month?

A) Nasdaq

B) S&P 500

C) Dow Jones Industrial Average

D) Germany’s Dax.

The answer is D. Since the second half of August, investors have increasingly turned to European equities, with the Dax one of the clear winners. It’s up 4.9% over the past 30 days. The Dow and Nasdaq are both in the red over that same period.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

***

Have a nice weekend, everyone. I’ll see you here on Monday.

Today's reads

Shattered glass. A hearty congratulations to Jane Fraser! She will take over the top role at Citigroup, becoming the first woman to helm a major Wall Street bank, "shattering one of the most enduring glass ceilings in finance."

The other crisis. America's financial system faces another existential threat: climate change. That makes sense, particularly to those of you on the West Coast who have been squinting at ash-choked skies this week. A new report from the U.S. Commodity Futures Trading Commission, lays out in stark detail that there are physical and transition risks of climate change that will exact "unprecedented disruption in the proper functioning of financial markets and institutions."

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

$70 million

That's Tesla's average net profit in recent quarters. In other words, the EV pioneer is barely profitable—any shock could send it back into the red. S&P 500 bean-counters know this, and no doubt figured the carmaker is just too precarious at the moment for inclusion in the benchmark index. But what could possibly dent Tesla's earnings potential? The Wall Street Journal's Charley Grant lays out a whopper of an argument: the biggest threat to Tesla profitability—and, in turn, S&P inclusion—is a series of payments due to founder Elon Musk.