This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters. Stocks are—shocker!—trading lower this morning even with the promise of more stimulus spending in the works. There’s data too showing the U.S. economy is not in such a dreadful state. The weak start to the trading day is a mere blip in what’s otherwise been a record two-month run in equities.

Let’s check in on the action.

Markets update

Asia

- The Asian indices are mixed, with Shanghai edging lower in afternoon trade.

- HSBC is the latest financial firm to publicly back Beijing’s new national security law, drawing criticism from Hong Kong’s top pro-democracy activist.

- Airlines look to be at the center of the latest spat between Beijing and Washington. China on Thursday said U.S. airlines are free to resume limited inbound service to the country a day after the Trump Administration said no to Chinese carriers. Your move, Washington.

Europe

- European bourses fell at the open this morning, with the benchmark STOXX Europe 600 down 0.2% one hour into trade, down off its lows.

- All eyes are on the ECB. The central bank meets again today to determine if its €750 billion PEPP asset-purchase plan is enough to revive the faltering eurozone economy. If it doesn’t boost that by a good half-trillion you could see equities take a hit, market watchers say.

- You wanted €100 billion stimulus plan, Ms. Merkel? Here’s €130 billion, German lawmakers decided. It’s a creative package, involving a cut in VAT, and billions to build out 5G data networks, improve railways and double incentives for electric vehicles. (Germany, in case you hadn’t noticed, is having a pretty good pandemic.)

U.S.

- U.S futures are down, but off their lows.

- A pause in the U.S. equities rally is bound to happen. Eventually. But until then, consider this: the S&P 500 is up more than 37% over the past 50 trading days, its best run ever. To repeat: Best. Run. Ever.

- This will be a big week for U.S. jobs data. The most timely of readings come out today with jobless claims. Forecasters are in accord: the labor market lost nearly 2 million jobs in the past week.

Elsewhere

- Gold is down.

- The dollar is up, but that’s small potatoes. The euro is on its biggest winning streak in seven years against the greenback. Grumble, grumble.

- Crude is falling. After climbing above $40/barrel, Brent is down 1.2% in morning trade.

Fear of FOMO

From Japanese bluechips to American small-caps, stocks are having a bull run for the ages. Growth stocks and cyclicals are on fire, and that’s despite economic data showing record job losses and a collapse in growth.

As we’ve discussed many times here in this space, the stock market is seeing a V-shaped recovery while the global economy is seeing anything but.

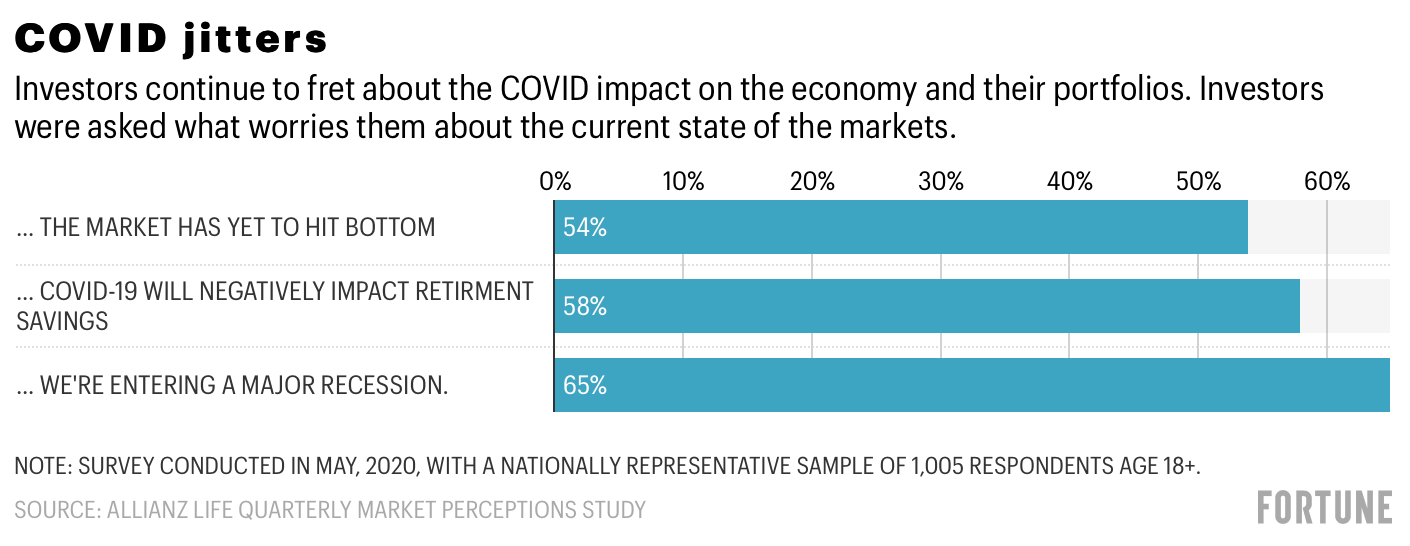

This disconnect can also be seen in the mindset of the investor. Allianz released its latest quarterly survey of investors late last week, showing there’s still plenty of concern about the COVID-19 impact on portfolios and on the wider economy. Take a look at this morning’s chart.

Nearly two-thirds of respondents believe we’re entering not just a recession, but a major recession. And another 58% see COVID having a negative impact on their retirement plans. Oh, and 54% believe the market has yet to hit bottom.

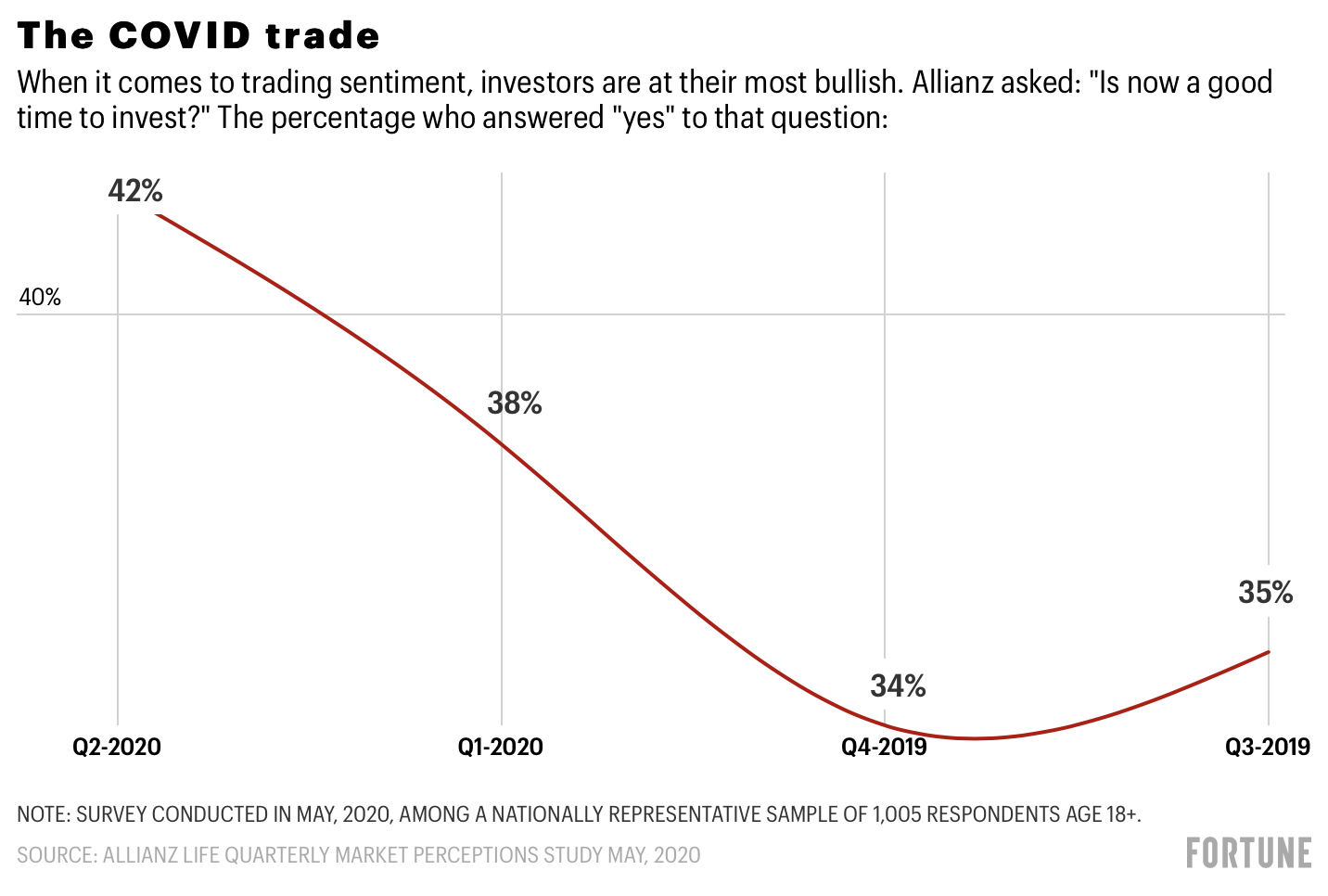

Now here comes the disconnect. The same investors are suffering a big case of FOMO. A fairly significant number don’t want to miss out on this incredible bull run, as the next chart (pulled from the very same Allianz survey) shows.

Allianz asks the survey panel every quarter whether now is a good time to invest. There’s been a big jump in those responding in the affirmative in the latest quarter, as the chart above shows. It’s still in the minority, but the more bullish trend is worth noting.

So how is it that there are both fears of a mega-recession and a fear-of-missing-out mood hanging over investors? I’m picturing the proverbial angel-on-one-shoulder/devil-on-the-other gripping investors as they see all traditional economic indicators of a healthy economy—employment, GDP— crash, and the markets soar.

So I open it up to the Bull Sheet community: do you see conflicting signs as it pertains to the future of your portfolio and the future of the economy? More to the point, does it even matter?

Shoot me a line, if you have a moment. I’m curious to get your take.

***

Have a nice day everyone. I’ll see you back here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune’s Outbreak newsletter will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

No takers. The Federal Reserve turned heads earlier this year when it promised a whatever-it-takes policy to bail out the ravaged corporate credit market. It vowed to buy corporate bonds, restoring calm. There's just one problem: the central bank is yet to buy a single bond, the Wall Street Journal reports.

It's the fiscal measures, stupid. Central bank intervention is probably responsible for much of the stock market run. What can keep it going? The wisdom of policy makers, explains The Wall Street Journal's Mike Bird.

(Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.)

Market candy

Blame it on millennials. The US Global Jets exchange-traded fund, (JETS) closed yesterday up 7%. More than $1 billion has now been poured into the fund, a favorite trade of Robinhood clients. What gives? As Frank Holmes, chief executive officer of JETS issuer U.S. Global Investors, told Bloomberg: “All these millennials, being stuck at home with no bars to go to and no beaches to travel to, took their money and became day traders. They’re bored, they want to make money.”