ECB President Mario Draghi couldn’t have been more dovish about tightening Eurozone policy for the first time in five years if he’d wanted to.

Yes, the ECB will cut the flow of stimulus to the Eurozone economy through the bond markets. Instead of pumping in 80 billion euros ($85 billion) a month through the bond markets, it will, as of April, only pump €60 billion. But it extended the program for nine months (to the end of 2017) instead of only the six months that markets expected, guaranteeing a minimum of €540 billion in stimulus as opposed to the €480 billion (€80 billion for six months) expected. As he said repeatedly during the press conference after the ECB’s governing council meeting, the bank will be a “presence” in the markets for a long time, pushing bond prices up.

Then there was the thoroughly asymmetric guidance. Purchases can be ramped up again if the outlook continues to disappoint, Draghi said. But he shot down suggestions they could be reduced further if growth and inflation pick up. That’s fair enough, given that the ECB’s base case assumes that inflation will still be undershooting in 2019, at only 1.7%, and that economic risks are still tilted to the downside.

The language used during the question and answer session was also important, as Draghi doesn’t usually bend English to suit his purpose. But he jumped on anyone who dared to use the word ‘taper,’ because of the associations it has with the Fed’s gradual exit from its extraordinary stimulus program. In Draghi’s dictionary, a ‘taper’ can only mean a reduction in purchases to zero, and nobody talked about that at today’s governing council meeting, he stressed. In the markets, of course, the word ‘taper’ invites the word ‘tantrum’–the violent bond market sell-offs that happened when the Fed started talking about a new policy cycle. The ECB doesn’t want that, not with Greece, Portugal and, most worryingly, Italy still stuck in their respective ruts.

Finally, there was a key tweak to the bond-buying program. The ECB will, if need be, buy bonds that are yielding less than its deposit rate of -0.4%. That removes the floor underneath benchmark (German) bond yields, widening a differential that will encourage people to sell the euro and buy pretty much anything else. German two-year bonds are now retesting record low yields at -0.73%.

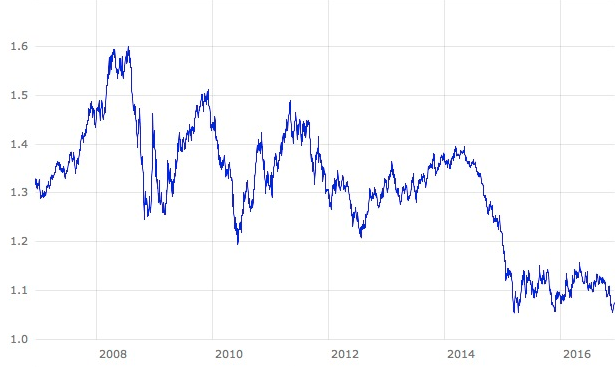

John McIntyre, a portfolio manager at Brandywine Investment Management in Philadelphia, says it all points to the ECB trying to create what bond market wonks call a ‘steep yield curve’–a big differential between short- and long-term rates. Typically, that’s associated with higher growth and inflation. The big premium on U.S. bonds (two-year Treasury notes now pay over 1.8 percentage points more than German ones) helps to explain why the euro lost two cents against the dollar on the news. Dollar-euro parity looms into view for the first time in over a decade. McIntyre points that it may not be till the end of next year, given how far the dollar has risen in 2016, and that any fiscal stimulus planned by the new Trump administration won’t be immediate.

Fundamentals also count: The Eurozone’s current account surplus is running at nearly 4% of GDP—the world’s largest macroeconomic imbalance.

But if the euro isn’t cheaper than a dollar this time next year, it won’t be because Frankfurt wasn’t trying.