A quiet fight between two of the most powerful names in finance burst into the open last week. In a letter to the Securities and Exchange Commission, Citadel Securities complained that crypto interests are poised to damage the U.S. stock market and harm consumer protections with a pell-mell rush into decentralized finance (DeFi). The firm didn’t directly say who it regards as responsible for this state of affairs—but it’s enough to guess from the footnotes, which refer to the venture giant Andreessen Horowitz more than 10 times.

The source of the dispute is the fast-growing world of tokenized equities, which let users trade shares of popular companies but in a blockchain wrapper. The likes of Robinhood, Kraken, and even BlackRock are all dabbling in this technology, whose advantages include easy 24/7 trading and instant settlement. Holding stock on a blockchain also reduces middlemen, and expands opportunities to deploy equity-based collateral.

So what’s not to like? According to Citadel, the problem is DeFi platforms like Uniswap. Right now, traders use them to swap billions of dollars of crypto every day—and soon large volumes of tokenized Nvidia or Apple stock could be sloshing around these platforms, too. And if the SEC grants certain exemptions that Andreessen and its DeFi allies are seeking, Uniswap and others will get to operate as de facto brokerages—without taking on the legal responsibilities that go with that. These include displaying the price of every trade or ensuring customers get the best price. Citadel also warns of “fragmenting liquidity” as stock investing gets split between two parallel systems.

In response to the letter, the founder of Uniswap (one of Andreessen’s blue-ribbon portfolio companies) took to X to accuse Citadel of slandering DeFi in order to protect its lucrative role as the “king of shady tradfi market makers.” Other prominent names in crypto piled on as well, accusing the firm of trying to smother innovation.

At first glance, it appears both sides have a point. If tokenized stock trading breaks into the mainstream, it would threaten Citadel’s business model of paying firms like Robinhood for their orders and using that volume to make trading profits. So the company’s letter to the SEC is clearly based in self-interest. That said, Citadel’s concerns about liquidity are not unreasonable—if the pool of U.S. stocks is divided into two separate pools, doesn’t that make trading more expensive for everyone? Likewise, it’s fair to ask if the SEC would be wise to grant exemptions on investor protection rules that have historically served the public very well.

In reading the letter, it’s remarkable to read its claims that the likes of automated AMMs, block builders, validators and layer 2 blockchains are basically brokerages—less for the argument itself, than that Citadel and the SEC are discussing this stuff at all. It wasn’t long ago when only a handful of crypto diehards knew what these terms even meant. Now, they have become mainstream enough to be part of a non-crypto firm’s correspondence with the SEC, and there is no doubt they’re here to stay.

As for which side is going to prevail, it’s worth noting the fight pits two of the most powerful firms in the country against each other. On one side, there is Citadel, which is owned by Ken Griffin, one of the richest and most combative people in the country. On the other is Andreessen, an influential VC firm that doubles as a PR firm and lobbying agency with immense clout in Washington, DC. For now, it feels Griffin may be able to slow down the spread of tokenized equities but, as with any superior technology, he will be unable to stop it.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Binance’s new look: The world’s biggest cryptocurrency exchange announced Yi He as co-CEO, confirming her status as the most powerful woman in crypto, while also establishing a de facto corporate headquarters for the first time via major licenses in Abu Dhabi. (Fortune)

Alt-coin winter: The recent downturn has battered alts with the sector shedding $200 billion since market peak. Memecoins have been hit particularly hard, due in part to the sheer number of them, but also because they are competing with a growing number of other speculative opportunities like prediction markets. (Bloomberg)

If at first you don’t succeed: Coinbase plans to relaunch in India early next year. It first opened shop in 2022, but was forced to retreat a year later in the face of hostile regulators who blocked its access to the country’s national payments network. (TechCrunch)

Mining mischief: The Malaysian government is using drones and a cross-agency task force to go after thousands of illegal Bitcoin mining operations that hop from place to place, and have stolen over $1 billion of electricity. (Bloomberg)

Saylor selling? The fraught world of DATs got dicier as Strategy said it might sell Bitcoin as a last resort. The move comes as Strategy’s share price fell below mNAV as the firm faces looming dividend obligations—but there is also a case that Saylor’s corporate strategy wizardry means the firm will be just fine. (Fortune)

MAIN CHARACTER OF THE WEEK

CZ wins the main character title this week as his debate with goldbug Peter Schiff helped drive a flood of social media attention around the Binance founder who looks very much back in the crypto game.

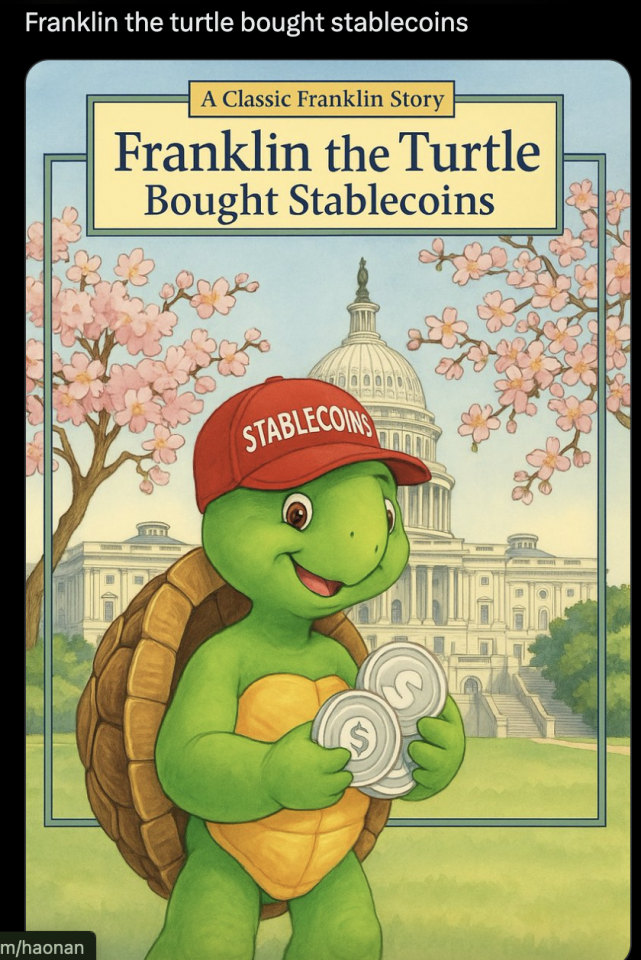

MEME O' THE MOMENT

After the U.S. Treasury Secretary Bessent co-opted beloved children’s character Franklin the Turtle to pitch T-bills, it didn’t take long for CT to expand the meme to stablecoins.