The Great Resignation is picking up steam. On Friday, we learned the quit rate hit a new record—with 4.4 million workers voluntarily quitting their jobs in September. The factors contributing to this phenomenon are numerous. The hot job market. Burnout. Retirements.

But there’s something else at play: Some workers are simply upset about the possibility of losing their increased WFH and schedule flexibility.

To see how much of a role WFH and work flexibility are playing, Fortune reached out to Future Forum, a consortium backed by Slack. Future Forum gave Fortune Analytics exclusive access to its recent survey of more than 10,569 knowledge workers or skilled office workers from around the world.

Here’s what we found.

The numbers to know

76%

- …of knowledge workers want flexibility in where they work. 93% want flexibility in when they work.

66%

- …of executives say they’re designing post-pandemic workforce policies with little to no direct input from employees. However, the same figure (66%) of executives say they’re being “very transparent” regarding their “post-pandemic” policies.

42%

- …of nonexecutives say their employer is being transparent regarding “post-pandemic” policies.

17%

- …of nonexecutives say in an ideal world they’d want to be in the office every day. Among executives, that figure is 44%.

57%

- …of knowledge workers say they’d be open to looking for a new job in 2022.

71%

- …of knowledge workers who aren’t satisfied with the level of flexibility in their current role say they’d be open to looking for a new job in 2022.

6.6 times

- …How much more likely workers who say their schedule is not flexible are to say they have work-related stress.

Big picture

- Workers want more flexibility and control over where they work—and they’re willing to quit over it. Indeed, among all workers, 57% are open to listening to offers next year. That figure is a staggering 71% among workers who aren’t happy with their current level of flexibility.

A few deeper takeaways

1. Stress is burning workers out.

Just last year, joblessness in the U.S. was at its highest level since the Great Depression. Scrambling to hold on to their jobs, workers started taking on extra responsibilities—something many of them continue to have today even though the economy has shifted into one of its strongest periods in recent memory. That explains why 19% of workers say their work-related stress is “poor,” and another 33% say it’s “fair.”

One way to fix it? Perhaps increased work flexibility. After all, Future Forum finds workers who say their schedule is not flexible are 6.6 times more likely to have work-related stress.

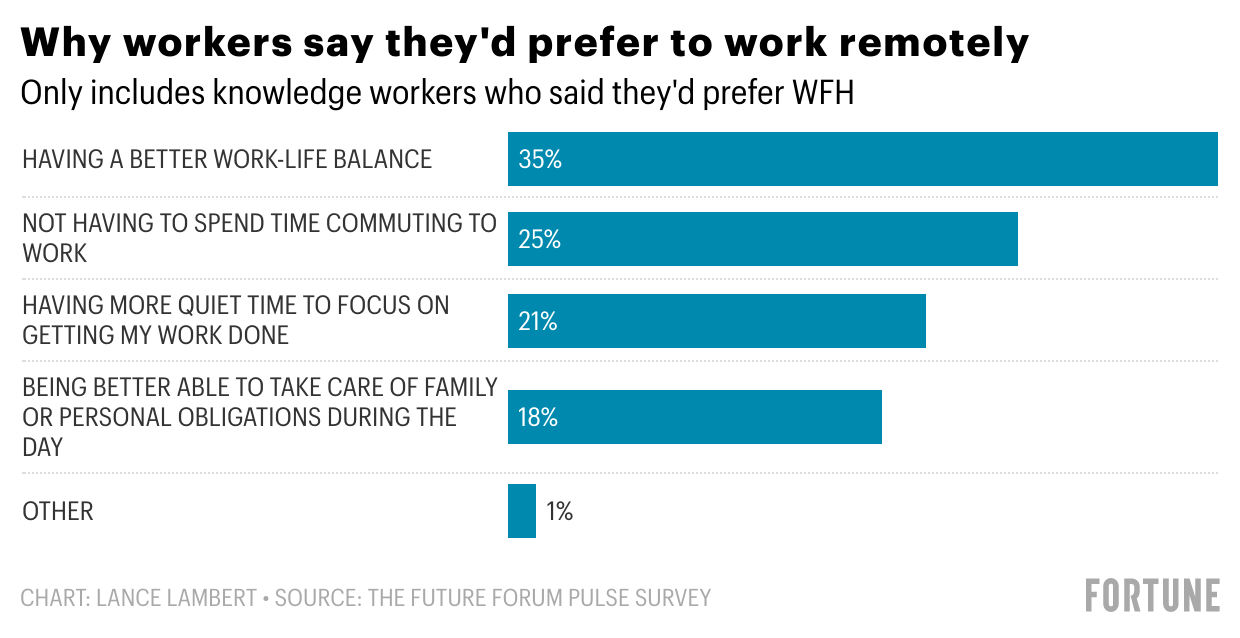

2. There’s not just one reason why so many workers crave WFH.

Among all knowledge workers, 71% of employees would prefer a hybrid or entirely remote schedule. But the reason why varies—a lot.

The most common answer is having a better work/life balance (35%), followed by not having to commute (25%), and getting more quiet time (21%). Another 18% cite getting more time to care for their family/personal obligations.

But regardless as to why, employers need to be listening. Two-thirds of executives say their post-pandemic workforce policies have little to no direct input from employees. Amid an economy with the highest “quits rate” in tabulated history, that could be a huge miscalculation.

I’d love to know what you think of the newsletter. Email me with feedback at lance.lambert@fortune.com.

Lance Lambert

@NewsLambert

*Methodology: The Future Forum Pulse survey was conducted in August among an audience of 10,569 “knowledge workers” or “skilled office workers” in Australia, France, Germany, Japan, United Kingdom, and the United States.

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.