Millions of adults in the U.S. are seeing their stimulus checks deposit into their bank accounts. The $2.2 trillion stimulus package set aside this money to help give households a lifeline as the pandemic disrupts the nation.

To find out how recipients are planning to spend these checks—which can go as high as $1,200 for individuals or $2,400 for married couples and $500 for each qualifying child—Fortune and SurveyMonkey teamed up to poll 5,755 U.S. adults* between April 10–14.

Not everyone will receive cash, including individual filers with adjusted gross incomes above $99,000. So only those who told us that they expect to receive an economic stimulus were asked how they’d spend it.

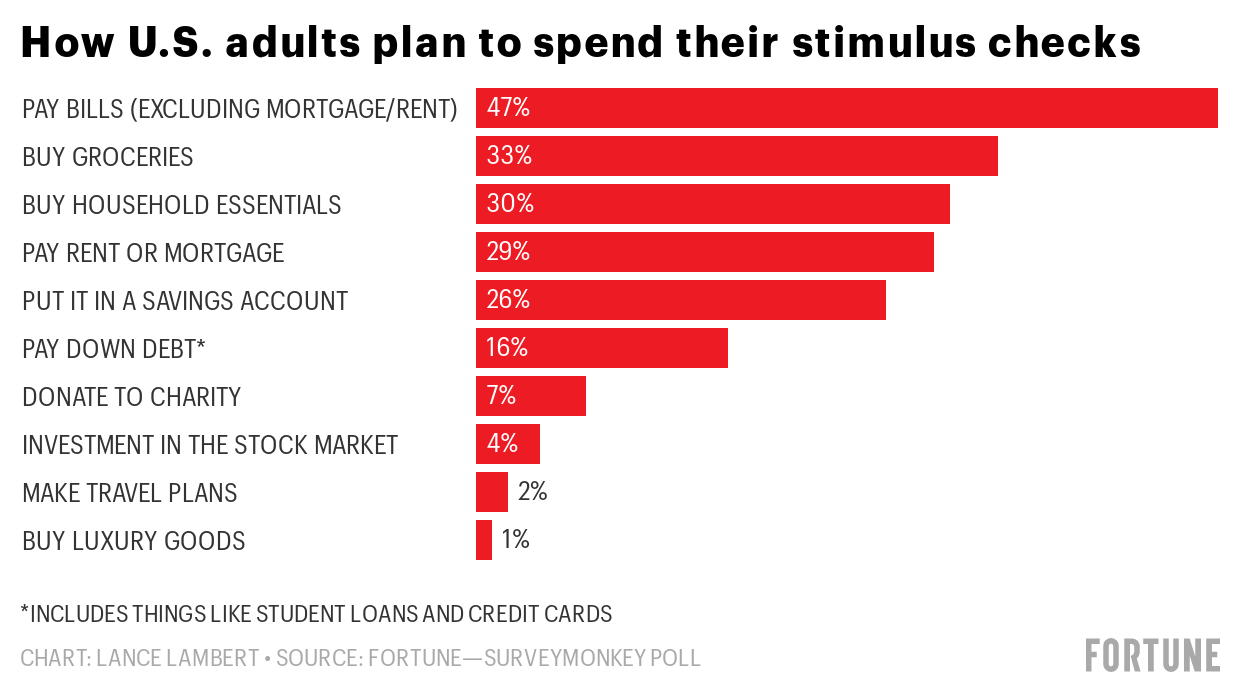

During income tax return season, U.S. adults are notorious for making big purchases like cars or booking cruises. That’s not the case with these stimulus checks. Most will use the checks to pay non-housing bills (47%), buy groceries (33%), buy household essentials (30%), or pay their rent or mortgage (29%). Only 2% told Fortune-SurveyMonkey that they plan to use the money on travel.

Many millennials entered the workforce during the brutal years following the 2008 financial crisis. Now the 20- and 30-somethings are staring down what appears to be another deep recession. These Millennials and Gen Xers are more likely to say they’ll use the money on bills or groceries than their baby boomer peers.

Among millennials, 41% say they’ll use some of the money to pay rent or their mortgage. That compares to 16% of baby boomers who said the same thing.

Black residents are both getting infected and dying at higher rates from COVID-19. And black households’ finances are clearly more strained. While 43% of white Americans plan to use some of the money to pay non-housing bills, that number is 60% for black adults and 52% for Hispanic adults.

*Methodology: The Fortune-SurveyMonkey poll was conducted among a national sample of 5,755 adults in the U.S. between April 10–14. This survey’s modeled error estimate is plus or minus 2 percentage points. The findings have been weighted for age, race, sex, education, and geography.

Looking for more insights like these?

As a perk of their subscription, Fortune Premium subscribers receive Fortune Analytics, an exclusive newsletter that shares in-depth research on the most discussed topics in the business world right now. Our findings come from special surveys we run and proprietary data we collect and analyze. Sign up to get them in your inbox.